For example, if the corporation is deferring a $100 LIFO recapture tax, subtract this amount from the total on line 11, then enter “Section 1363—Deferred Tax—$100” on the dotted line next to line 11. If the corporation used the income forecast method to depreciate property, it must figure any interest due or to be refunded using the look-back method, described in section 167(g)(2). Use Form 8866 to figure any interest due or to be refunded. If the corporation disposed of investment credit property or changed its use before the end of the 5-year recapture period under section 50(a), enter the increase in tax from Form 4255.

How did the Tax Cuts and Jobs Act (TCJA) affect NOL carryforwards?

This carryback is mandatory unless the taxpayer elects to forgo the carryback. If the company purchases raw materials and supplies them to a subcontractor to produce the finished product, but retains title to the product, the company is considered a manufacturer and must use one of the manufacturing codes (311110–339900). If filing a consolidated return, report total consolidated assets, liabilities, and shareholder’s equity for all corporations joining in the return. Check “Yes” if the corporation has an election in effect to exclude a real property trade or business or a farming business from section 163(j).

Specific Instructions

Generally, the corporation must file Form 7004 by the regular due date of the return. If the corporation held a qualified investment in a QOF at any time during the year, the corporation must file its return with Form 8997 attached. To certify as a qualified opportunity fund (QOF), the corporation must file Form 1120 and attach Form 8996, even if the corporation had no income or expenses to report. Imagine a company that had an NOL of $5 million one year and a taxable income of $6 million the next. The carryover limit of 80% of $6 million is $4.8 million. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses.

Drafting software, service & guidance

For amortization that begins during the current tax year, complete and attach Form 4562, Depreciation and Amortization. For more information on the uniform capitalization rules, see Pub. Also, see Regulations sections 1.263A-1 through 1.263A-3. See section 263A(d), Regulations section 1.263A-4, and nol carryover worksheet excel Pub. 225 for rules for property produced in a farming business. Corporations that qualify to use the nonaccrual experience method should attach a statement to its return showing total gross receipts, the amount not accrued because of the application of section 448(d)(5), and the net amount accrued.

- You can calculate the amount and manually enter it in any desktop version.

- If patronage dividends or per-unit retain allocations are included on line 20, identify the total of these amounts in a statement attached to Form 1120.

- If the partnership agreement does not express the partner’s share of profit, loss, and capital as fixed percentages, use a reasonable method in arriving at the percentage items for the purposes of completing question 5b.

- Anyone who prepares Form 1120 but does not charge the corporation should not complete that section.

The election must be made by the due date of the return, including extensions. Generally, you can only carry NOLs arising in tax years ending after 2020 to a later year. An exception applies to certain farming losses, which may be carried back 2 years.

If the resulting figure is negative, there’s a net operating loss. When this happens, the business can carry some of its tax deductions forward to years when it has a profit. This process benefits businesses with large amounts of debt or high costs of goods sold. If they have major expansion plans, this deduction may be used to reduce the tax liability. A net operating loss must be caused by certain deductions, like having a slow year with little profit, property damages, natural disasters, high business expenses, theft, moving costs, and rental property expenses. The IRS is committed to serving taxpayers with limited-English proficiency (LEP) by offering OPI services.

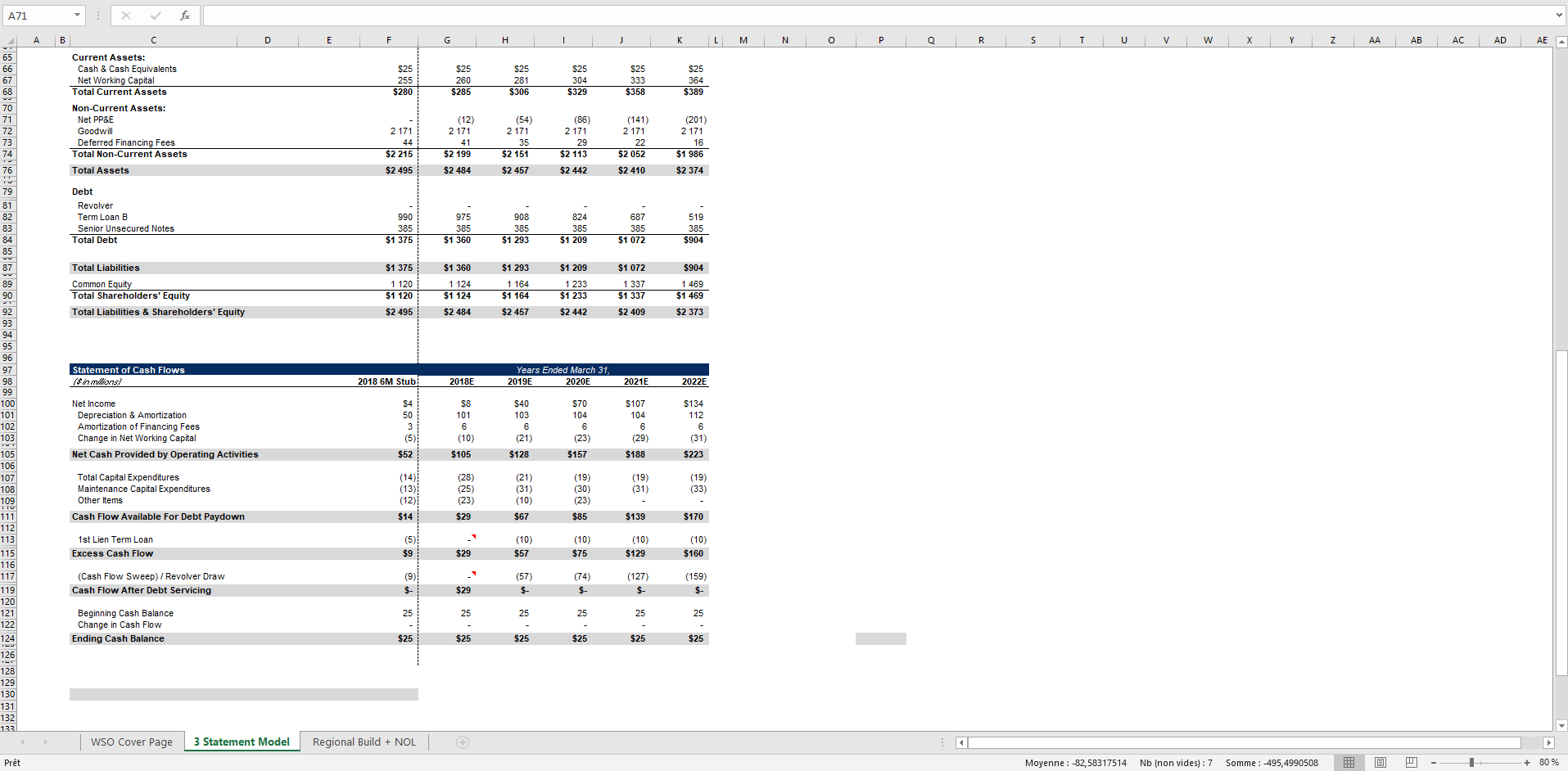

Some cases, like a loss as a farmer, may allow for a carryback period. The remaining amount could then be used indefinitely with restrictions. In conclusion, we can see the tax benefits gradually decline following the period of unprofitability in 2019. By 2022, the NOL ending balance reverses (i.e., returns to zero) as the tax savings from the NOLs decline from $105k in 2019 to $21k. Target NOLs can be used to offset the seller’s gain on sale since the 2017 Tax Reform has been set at 80% of the target’s taxable income (TCJA). However, the tax benefit — i.e., the NOLs offset some of the taxes in the future — is not realized until the company actually turns a profit.

NOL is first used to offset the income in the NOL year. If it exceeds 80% of that year’s income, it can then be used to offset a company’s tax payments in future tax periods using an IRS tax provision called loss carryforward. New businesses are most at risk of operating at a loss because they haven’t started making revenues yet. This is especially true for businesses that have a start-up phase. In these scenarios, the losses are carried forward to create future tax reliefs.

See the instructions for Schedule J, Part II, line 22. The electronic-filing threshold for corporate returns required to be filed on or after January 1, 2024, has decreased to 10 or more returns. From the 2021 tax year, you can no longer carry back a loss from one year to a previous year.

Life Mídia Inc.

Life Mídia Inc.